澳门认证✔九游娱乐【2024欧洲杯】

🔥首存100赠送38! 无限活动!

🔥首充即送! 高达6888元!

🔥大额无忧 豪客首选 | 单日取款无上限

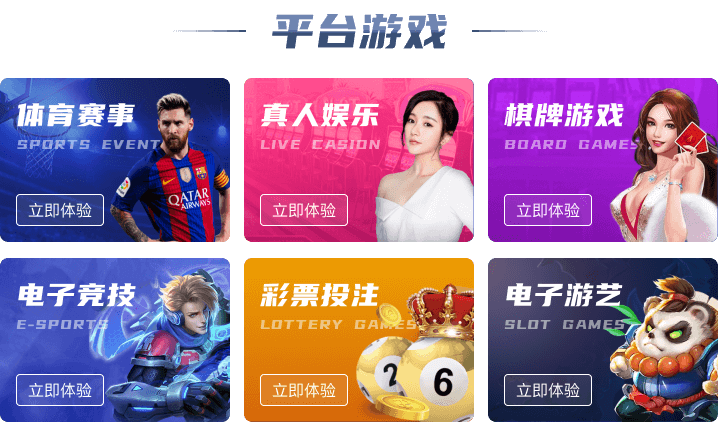

- ·真人视讯

- ·电子游戏

- ·体育投注

- ·彩票棋牌

- ·电竞投注

- ·电子娱乐

九游棋牌官网

- 最专业棋牌品牌 尽享满冠

▶

星空娱乐官网

- 最高返水1.20%🔥

- 澳门官方直营品牌

▶

九游体育全站APP

安全、最快的存款和取款 点击进入

超高返利带您玩转真人视讯

完成新手任务好礼等您来

星空娱乐全站APP

美女主播在线畅聊

红单推荐赛事分析晒单功能精彩连麦

多元化的玩法 投注赛事